Bitkom industry growing again

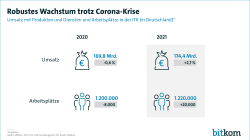

- Forecast: ICT sales to rise by 2.7 percent to 174.4 billion EUR in 2021

- Upswing in mood: Business climate reaches highest level since February 2020

Berlin, 13th January 2021 - Following the COVID19 contraction and declining sales, the signs in the Bitkom industry are pointing towards growth again for 2021. The German market for IT, telecommunications and consumer electronics is expected to grow by 2.7 percent to 174.4 billion EUR this year. Companies in Germany are expected to create 20,000 additional jobs by the end of the year. Currently, 1.2 million people are employed in the industry. Already in the closing months of last year, the business climate developed positively for the most part. Bitkom’s-ifo digital index climbed in December to its highest level since February 2020. "The Corona crisis has accelerated digitalisation in many areas. Business, government and consumers are investing in digital technologies, and investments that were postponed are now being made up for," says Bitkom President Achim Berg. "Our industry has come through the crisis well so far. For 2021, the signs are pointing towards growth again." Under the impact of the crisis, sales had fallen slightly in 2020. The ICT market declined by 0.6 per cent to 169.8 billion EUR, mainly due to weaker business with IT services and software.

IT hardware is the biggest turnover driver in information technology

After temporary losses, the importance of the information technology segment will increase again in 2021 and continues to be the largest industry segment. According to Bitkom calculations, sales will increase by 4.2 percent to 98.6 billion EUR in 2021. IT hardware - i.e. in particular computers, servers and peripherals - will grow the most with a strong increase of 8.6 percent to 31.6 billion EUR. The market for software is also growing again. With a plus of 4.1 percent to 27.0 billion EUR, it is growing stronger than the industry average. The IT services business, which includes IT consulting, is back in the black with 1.1 per cent growth to 40.0 billion EUR. "While IT hardware is at the top of the shopping list, another trend in information technology is gaining ground with the strongly growing cloud business. It is increasingly a case of renting instead of buying. Infrastructure-as-a-Service, i.e. the business with rented servers, network and storage capacities, recently recorded annual growth rates of up to 40 percent and is now a market worth billions," says Berg.

Telecommunications growing moderately

Telecommunications is expected to record moderate growth. In 2021, the market is expected to increase by 1.0 percent to 67.4 billion EUR after two years of consolidation. According to Bitkom calculations, 48.7 billion EUR will be generated with telecommunications services, which corresponds to a slight increase of 0.3 percent. Business with end devices will grow to 11.6 billion EUR (+2.8 per cent). Investments in the telecommunications infrastructure increase significantly by 3.2 percent to 7.1 billion EUR. "The network operators are investing massively in the future of fixed and mobile networks. The expansion of fibre optics and the new 5G mobile standard are an important contribution to meeting the continuously increasing demands on speed and availability. Refinancing remains a major challenge for the telecommunications companies in view of only low revenue growth due to the high competitive pressure," says Berg.

Consumer electronics in the red again

Consumer electronics continues to be on a downward slide. According to Bitkom forecasts, sales in 2021 will fall for the fourth year in a row, although less sharply than recently. This smallest ICT submarket is expected to shrink by 2.0 percent to 8.3 billion EUR. Berg: "Consumer electronics are still under strong pressure despite the Corona-related boom in individual areas. The special boom for game consoles, wearables and headsets cannot stop the downward trend. The good news is that the declines are slowing."

More jobs, less global market share

Previously strong employment growth is levelling off slightly in the wake of the COVID19 crisis. 20,000 additional jobs are expected to be created in 2021, after the number of jobs fell slightly by 8,000 to 1.2 million last year. In 2019, 58,000 new jobs had still been created. "Bitkom’s industry has created 150,000 additional jobs in the past five years alone. Digitisation not only leads to more efficiency and productivity across all industries, it also increases the demand for labour," says Berg. "The employment balance could be much better if many jobs did not have to remain unfilled due to a lack of skilled workers. Even in the crisis year 2020, 86,000 jobs would remain vacant. Every unfilled job represents less growth, value creation and innovation - this slows us down in digitalisation and hinders us in global competition. Good and digitally competent people are the most important factor when it comes to bringing Germany forward digitally and regaining digital sovereignty."

On a global scale, the German ICT market plays a subordinate role. The market share is expected to be 3.9 percent in 2021. The trend is downward because investments and spending are growing faster in other countries, especially in the Asian region. The growth leaders are India (+13.5 percent) and China (+7.1 percent).